Life Insurance Corporation of India (LIC), founded in 1956, has become an icon in India’s insurance industry since then. Today it stands as a household brand.

Indians of all economic standings have felt secure financially thanks to LIC, India’s largest insurer. We will discuss its likely share price future between 2025, 2027, 2030 and 2040 based on expert opinions as well as consider whether buying stock of this organization makes financial sense.

About ( LIC Share Price Target 2025 to 2040 )

Life Insurance Corporation of India (LIC), one of India’s premier public sector life insurers headquartered in Mumbai. Established on September 1, 1956 by virtue of the Life Insurance of India Act (1956), it operates under the administrative control of the Ministry of Finance. LIC was formed as a nationalized entity by consolidating more than 245 insurance companies and provident societies, serving as the backbone of India’s insurance industry. With an AUM of Rs45.7 trillion (US$570 billion), as of March 2023, LIC was India’s premier insurance company and major institutional investor. Its wide reach and long history have solidified their place within India’s financial landscape.

Financial Data Analysis Of LIC Company

At first, it is necessary to gain an overview of a company’s key performance measures like PE ratio, return on assets ratios and current ratio. We discuss their performance below as well as any impact it might have on an LIC share price target that depends on these ratios.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 17.24 | 0.77% | 3.10 | 49.46% |

Recent Graph of LIC Share Price

See More : Bajaj housing finance share price target 2025 to 2040

Fundamental Analysis

| Attribute | Details |

|---|---|

| Open | ₹830.00 |

| Previous Close | ₹828.20 |

| Volume | 324,620 |

| Value (Lacs) | ₹2,690.94 |

| VWAP | ₹832.04 |

| Beta | 1.37 |

| Market Cap (Rs. Cr.) | ₹524,310 |

| High | ₹836.65 |

| Low | ₹827.05 |

| Upper Circuit Limit | ₹911.00 |

| Lower Circuit Limit | ₹745.40 |

| 52-Week High | ₹1,222.00 |

| 52-Week Low | ₹805.00 |

| Face Value | ₹10 |

| All-Time High | ₹1,222.00 |

| All-Time Low | ₹530.05 |

| 20-Day Average Volume | 2,857,625 |

| 20-Day Avg Delivery (%) | 12.66% |

| Book Value Per Share | ₹152.77 |

| Dividend Yield | 1.21% |

LIC Share Price Target 2025

By 2025, Life Insurance Corporation of India’s share price target should range between Rs1,763 and 2,135. Market presence, profitability and industry expansion drive this optimism.

| Month (2025) | Minimum Target (₹) | Maximum Target (₹) |

| January | 1,763 | 1790 |

| February | 1778 | 1800 |

| March | 1790 | 1833 |

| April | 1830 | 1848 |

| May | 1832 | 1860 |

| June | 1855 | 1875 |

| July | 1871 | 1895 |

| August | 1890 | 1935 |

| September | 1900 | 1944 |

| October | 1940 | 1990 |

| November | 1970 | 2030 |

| December | 2089 | 2135 |

LIC Share Price Target 2027

2022 saw premium income total Rs4,27,546 Crore; this number increased to Rs4.38.858 Crore in 2023. Of 204.65 Lacs policies sold, 36% (73,15 Lacs policies purchased by women out of 674 policies issued to men) were brought by female agents while 64% came from men agents; thus making up 48% of LIC share investments from 6,99,429 female agents in total.

| Year | LIC Share Price Target 2027 |

| Minimum Target | 2,036 |

| Maximum Target | 2,396 |

Since 2014, sales at this company have also seen steady increases over time; 72.23% in 3 years to 196.56% over one. Total assets amounted to Rs42.30356 Crore in 2022 before rising to Rs45516889 Crore by 2023; one possible target for 2027 pricing could be set as follows; Rs2,036.01 first and 2,396.12 as second price targets respectively.

LIC Share Price Target 2030

By 2030, it’s anticipated that LIC Housing Finance will emerge as market leader of India’s Housing Finance Industry. LICHSGFIN’s share price may potentially hit between Rs2,300/- to Rs3,550/- by then due to strategic focus on digital platforms, product innovation and customer centricity; according to projections made here.

| Month | Minimum Price (₹) | Maximum Price (₹) |

| January | 2,300 | 2,450 |

| February | 2,400 | 2,550 |

| March | 2,500 | 2,650 |

| April | 2,600 | 2,750 |

| May | 2,700 | 2,850 |

| June | 2,800 | 2,950 |

| July | 2,900 | 3,050 |

| August | 3,000 | 3,150 |

| September | 3,100 | 3,250 |

| October | 3,200 | 3,350 |

| November | 3,300 | 3,450 |

| December | 3,400 | 3,550 |

LIC Share Price Target 2040

One of the key features of our company is their online facilities for Loan Payment and Repayment, Unit-Linked Fund Switch and Change Nominations/Assignments for Agents – these processes being extremely helpful for agents themselves! Out of all agent population in India, 49.2% hails from rural locations – these agents account for 23.4% of individual policies sold while 17.5% make up new business assured.

| Year | LIC Share Price Target 2040 |

| Minimum Price (₹) | 6,226 |

| Maximum Price (₹) | 6,536 |

tocks (LIC) depends on several variables. At present priced at Rs975.30, analysts expect the share prices of LIC to increase gradually until 2024 and 2025; specifically to Rs990.62 by 2024 and 1,363.98-2 532.91 by 2025 respectively. LIC stands to benefit from expansion thanks to strong market presence, government support, and diverse products available; investors should carefully consider market circumstances as well as personal financial objectives before investing. For optimal investment outcomes it would also be prudent to consult a financial adviser beforehand.

Bull Case

As the insurance industry evolves, regulatory issues could wreak havoc with operations and profits of life insurers (LICs). Private insurer competition could reduce market share and profit margins; and market instability can cause their stock price to fluctuate putting investors’ capital at risk.

An economic recession could cut consumer spending on insurance policies, leading to lower sales and income for LifeCo. Because they are owned by government, bureaucratic inefficiencies may inhibit them from adapting quickly enough.

Bear Case

Regulation issues could threaten LifeCo operations and profits as the insurance industry evolves, due to private insurer competition cutting market share and profit margins; their stock may even fluctuate due to market fluctuations risking investors’ funds.

Recession can lower consumer spending on insurance policies and sales and income for Life Companies of Canada (LIC). Without adequate assistance to adapt to market changes due to bureaucratic inefficiency as an independent government-owned corporation, they may lose out.

Is LIC Stock Good to Buy?

Finally, when purchasing LIC stock it should only be done after careful evaluation of company fundamentals, market circumstances and investment goals.

Shareholding Pattern

| Category/Period | Dec 2024 |

|---|---|

| Promoters + | 96.50% |

| FIIs + | 0.07% |

| DIIs + | 1.26% |

| Public + | 2.15% |

| No. of Shareholders | 23,75,396 |

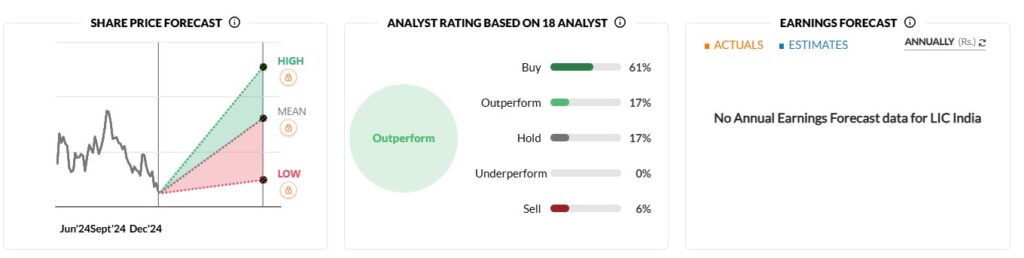

Forecast

Peer comparison

- Life Insurance

- SBI Life Insurance

- HDFC Life Insurance

- ICICI Lombard

- ICICI Pru Life Insurance

- General Insurance

- New India Assurance

Quarterly Results

| Category/Period | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|

| Sales (₹ Cr.) | 238,968 | 211,952 | 231,132 |

| Expenses (₹ Cr.) | 238,717 | 202,180 | 224,544 |

| Operating Profit | 252 | 9,773 | 6,588 |

| OPM % | 0% | 5% | 3% |

| Other Income (₹ Cr.) | 14,249 | 1,001 | 794 |

| Interest (₹ Cr.) | 0 | 0 | 0 |

| Depreciation (₹ Cr.) | 0 | 0 | 0 |

| Profit Before Tax | 14,500 | 10,774 | 7,382 |

| Tax % | 14% | 15% | 16% |

| Net Profit (₹ Cr.) | 13,784 | 10,527 | 7,723 |

| EPS in ₹ | 21.79 | 16.67 | 12.22 |

Sales Growth: The company reported sales of Rs238,968 crore in March 2024, Rs211,952 crore in June 2024, and Rs231,132 crore in September 2024.

Expenses: Total expenditures were Rs238,717 crore in March 2024, Rs202,180 crore in June 2024 and Rs224,544 crore by September 2024.

Operating Profit: In spite of fluctuating expenses, operating profit was Rs252 crore in March 2024 and increased dramatically to reach Rs9,773 crore by June 2024 and Rs6,588 crore by September 2024.

Operating Profit Margin (OPM): Over this period, OPM fluctuated between zero in March, rising to five percent in June and slightly decreasing to three percent by September.

Other Income: In March 2024, the company reported earning Rs14,249 crore from other income sources, but that figure fell to Rs1,001 crore by June and Rs794 crore by September.

Profit Before Tax (PBT): PBT totalled Rs14,500 crore in March 2024; Rs10,774 crore was earned during June and Rs7,382 in September.

Tax Expense: The respective quarterly tax rates were 14%, 15% and 16%. Net Profit: After reaching Rs13,784 crore in March 2024, net profit decreased significantly during June and September to reach only Rs10,527 crore and Rs7,723 crore respectively.

Earnings Per Share (EPS): EPS followed the same trend as net profit, reaching Rs21.79 in March, Rs16.67 in June and Rs12.22 in September.

Profit & Loss

| Category/Period | Mar 2023 | Mar 2024 | TTM |

|---|---|---|---|

| Sales + | 784,628 | 845,966 | 896,106 |

| Expenses + | 750,420 | 813,188 | 870,255 |

| Operating Profit | 34,207 | 32,779 | 25,851 |

| OPM % | 4% | 4% | 3% |

| Other Income + | 7,800 | 14,829 | 16,250 |

| Interest | 77 | 128 | 0 |

| Depreciation | 466 | 466 | 0 |

| Profit before tax | 41,463 | 47,014 | 42,102 |

| Tax % | 13% | 13% | |

| Net Profit + | 35,997 | 40,916 | 41,468 |

| EPS in Rs | 64.69 | 65.65 | 65.65 |

| Dividend Payout % | 5% | 15% |

Sales for March 2023 totalled Rs784,628 million, increasing to Rs845,966 in March 2024 and reaching an impressive total sales figure of Rs896,106 over twelve months (TTM).

expenses increased from Rs750,420 million in March 2023 to Rs813,188 million in March 2024; with TTM expenses climbing accordingly to reach a total of Rs8870255 million.

Operating Profit for March 2023 totalled Rs34,207 million before decreasing slightly to Rs32,779 million by March 2024 with TTM showing lower levels at Rs25,851 million.

Operating Profit Margin (OPM) stood at 4% both for March 2023 and 2024 but had fallen to 3% during this timeframe.

Other Income saw a steady climb from Rs7,800 million in March 2023 to Rs14,829 million by March 2024, with TTM showing further expansion up to Rs16,250 million.

At Rs77 Million and Rs128 Million respectively in March 2023 and 2024 respectively, Interest expenses were reasonably minimal, yet none was recorded within TTM.

Depreciation was Rs466 million for both March 2023 and 2024, without any account for TTM depreciation.

Profit Before Tax increased from Rs41,463 million in March 2023 to Rs47,014 million by March 2024 with TTM of Rs42,102 million.

Tax Percentages in March 2023 and March 2024 both remained consistent at 13%.

Net Profit increased from Rs35.997 Million in March 2023 to Rs40,916 Million by March 2024; total TTM net Profit totalled 41 468 Million.

Earnings Per Share (EPS) saw an increase from Rs64.69 in March 2023 to Rs65.65 by March 2024.

Dividend Payout Percentages have increased from 5% in March 2023 to 15% by March 2024.

Balance Sheet

| Category/Period | Mar 2024 | Sep 2024 |

|---|---|---|

| Equity Capital | 6,325 | 6,325 |

| Reserves | 76,422 | 91,312 |

| Borrowings + | 0 | 10 |

| Other Liabilities + | 5,233,300 | 5,621,474 |

| Total Liabilities | 5,316,047 | 5,719,121 |

| Fixed Assets + | 20,667 | 4,197 |

| CWIP | 403 | 0 |

| Investments | 4,976,133 | 5,413,779 |

| Other Assets + | 318,844 | 301,145 |

| Total Assets | 5,316,047 | 5,719,121 |

Conclusion

Predictions for the 2024-2040 price predictions of Life Insurance Corporation of India share prices are optimistic due to its strong market position and projected insurance sector development. With estimates at Rs945.31 for 2024-2050 and Rs10,000 by 2050 respectively, LIC appears poised to maintain its insurance supremacy for years.